when will estate tax exemption sunset

For instance a married. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

Creating Estate Tax Plans Under The Biden Administration

The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

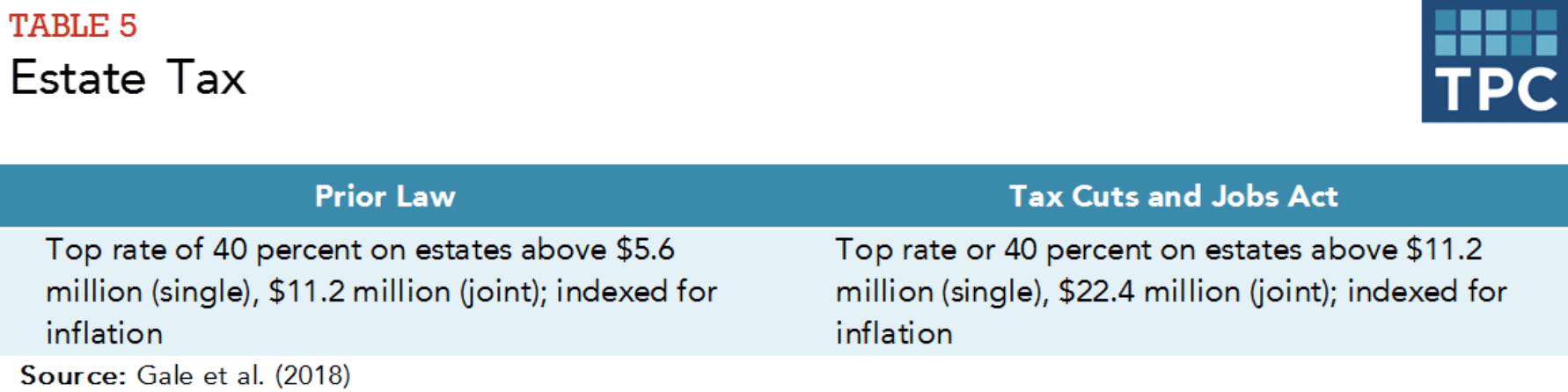

. On the contrary because of the scheduled sunset of current estate tax laws in 2026 you should read this article carefully if your estate will likely be worth more than half the. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with. Fast-forward to 2026 and the estate and gift tax exemption.

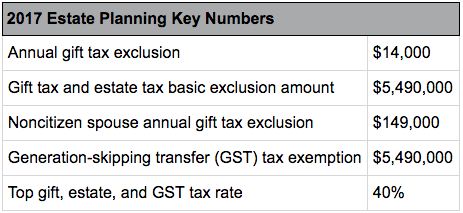

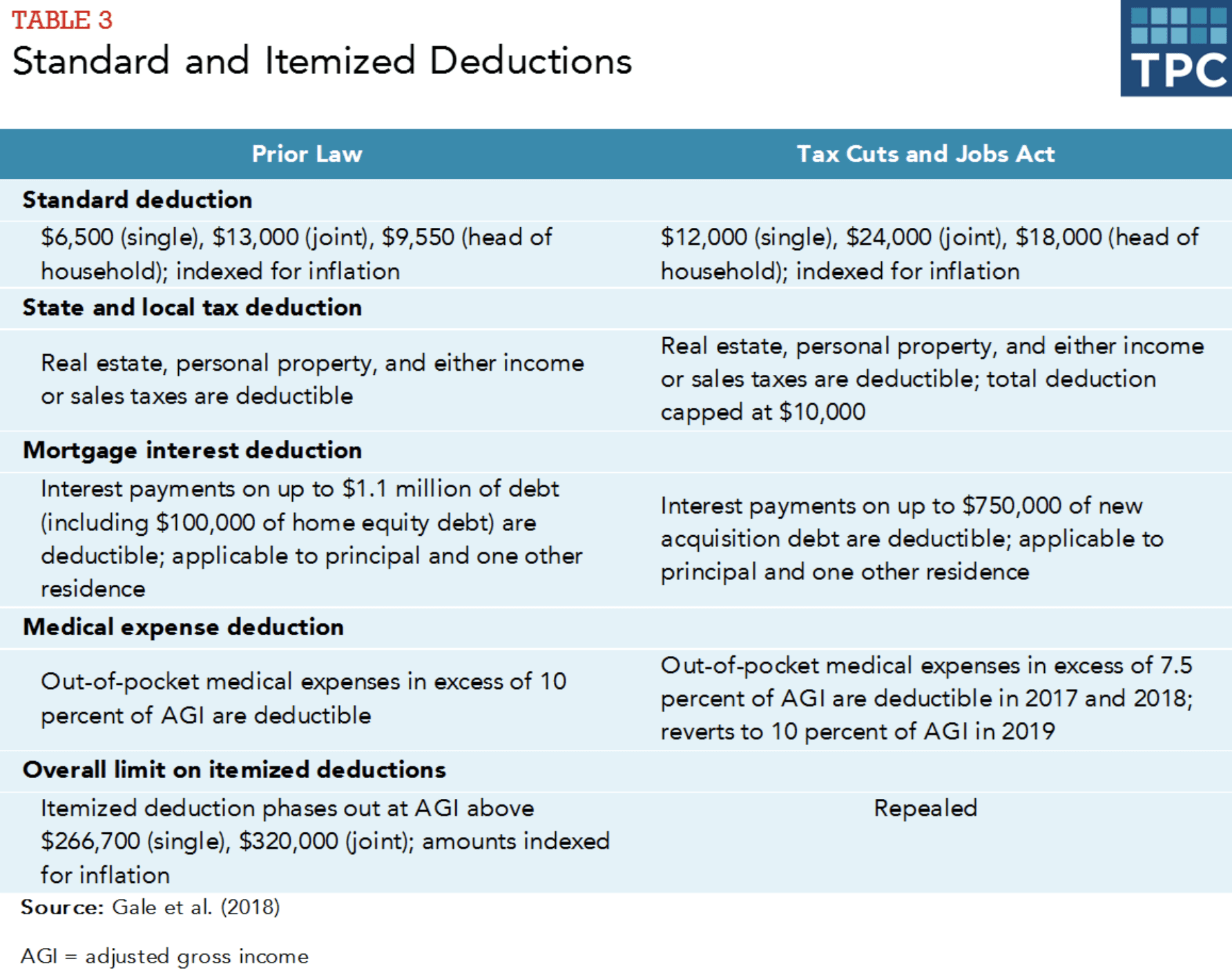

The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. Estate Tax Exemption. Starting January 1 2026 the exemption will return to 549 million.

Because the BEA is adjusted annually for inflation the 2018. The tax reform law doubled the BEA for tax-years 2018 through 2025. Fast-forward to 2026 and the estate and gift tax exemption.

The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in 2018. 2 In addition the 40. After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million.

This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts and Jobs Act TCJA are due to expire or sunset. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes.

This set the stage for greater. The federal estate tax exemption is set to sunset at the end of 2025. Unless your estate planning is.

If you have a sizeable estate another large opportunity to take advantage of before the 2025 sunset is the increased estate and gift tax exemption. The estate planning environment has changed over the last decade. How did the tax reform law change gift and estate taxes.

This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. What happens to estate tax exemption in 2026. If you believe you will be subject to the AMT exemption after these tax rates sunset in 2026 reach out to a tax professional about what your best plan of action might be.

After 2025 the exemption amount will sunset a fancy way of. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed.

The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. The current estate and gift tax exemption is scheduled to end on the last day of 2025. The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006.

This gives most families plenty of estate planning leeway.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

An Evaluation Of The Future Of Federal Estate Tax Koss Olinger

Opinion Preparing For The Great Sunset What You Need To Know If Tax Code Provisions Expire Marketwatch

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Gift Money Now Before Estate Tax Laws Sunset In 2025 Press Enterprise

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Estate And Gift Tax Exemption Use It Or Lose It Evercore

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

The Case For Wealthy Clients Using Their Gift Tax Exemptions Now Financial Planning

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Florida Attorney For Federal Estate Taxes Karp Law Firm

New Administration New Estate Tax Complications How To Prepare Clients For The Big Shift Vanilla

Preparing For The 2025 Tax Sunset Creative Planning

No Need To Fear A Federal Claw Back Twomey Latham

No Federal Estate Tax On Large Gifts When Exemption Sunsets Ross Law Firm Ltd

Four More Years For The Heightened Gift And Tax Estate Exclusion

To Port Or Not To Port Is Filing For Portability Right For You Bartlett Pringle Wolf Santa Barbara Accounting Tax Audit Services